Top 7 Dark Web Marketplaces of 2025: Exploring the Hidden Digital Economy

Dark Web Marketplaces in 2025: A Quick Overview

Despite major law enforcement takedowns, the dark web economy remains active in 2025. A small number of dominant marketplaces continue to drive illicit trade, acting as multi-purpose hubs for drugs, stolen data, financial fraud, and digital goods.

The most influential darknet markets this year include Abacus, STYX, Brian’s Club, Russian Market, BidenCash (before its mid-2025 takedown), WeTheNorth, and TorZon. Some operate as global marketplaces, while others specialize in areas such as credit card fraud, breached credentials, or regional trade.

These platforms run on the Tor network, rely on cryptocurrencies like Bitcoin and Monero, and commonly use escrow systems and invite-only access to reduce risk. Despite frequent shutdowns and exit scams, demand remains strong, making these markets key hubs for cybercrime.

Understanding which darknet markets are active — and what they sell — is essential for cybersecurity teams, threat intelligence analysts, and organizations monitoring data exposure risks. In this article, we break down the top 7 dark web marketplaces of 2025, how they operate, and why they continue to matter.

1. Abacus Market

Abacus Market, launched in 2021, quickly became the dominant English-language darknet marketplace following the collapse of earlier giants such as AlphaBay. It effectively filled the void left by AlphaBay’s 2017 takedown, attracting users and vendors from markets that shut down in subsequent years.

By late 2024, Abacus was widely regarded as the largest Western darknet market, featuring more than 40,000 active listings and an estimated market value of around $15 million. Until mid-2025, it functioned as a true one-stop shop of the dark web, earning comparisons to the “Amazon” of illicit goods due to its size, reach, and variety of contraband offered by thousands of vendors.

2. STYX Market

STYX Market emerged in 2023 as a specialized darknet marketplace focused on financial fraud and stolen data. Following the takedown of major fraud-centric platforms such as Genesis Market in April 2023, STYX quickly filled the gap, drawing significant attention within cybercriminal circles.

Often viewed as the go-to destination for stolen financial information, compromised credentials, and money laundering services, STYX positioned itself as a high-value niche marketplace rather than a mass-market platform.

By 2025, STYX has become a rising force in the underground economy. While smaller than large drug-focused markets, it is highly regarded among fraudsters for its exclusive offerings, strong security measures, and reputation for reliability.

3. Brian’s Club

Brian’s Club (also known as Brian’sClub or Brian*CC) is one of the most notorious carding marketplaces on the dark web. Active since 2014, it ranks among the longest-running illicit platforms still operating.

As its name humorously suggests—widely believed to reference cybersecurity journalist Brian Krebs—the marketplace specializes in selling stolen credit card data and related personal information. Over the past decade, Brian’s Club has built a reputation for providing large volumes of compromised payment card details, making it a trusted source within fraud circles.

Despite suffering a major breach in 2019, when its data was leaked—reportedly by law enforcement or vigilantes—the site managed to recover and continue operating into 2025. Today, many cybercriminals view Brian’s Club as a cornerstone of the underground economy for payment card fraud.

4. Russian Market

Russian Market, active since around 2019, is a major dark web marketplace specializing in stolen data and compromised accounts. Despite its name, the platform operates primarily in English and serves a global audience.

It has become one of the go-to destinations for cybercriminals seeking hacked credentials, personal data, and access to compromised services. While the name likely reflects the strong presence of Russian-speaking actors in the fraud ecosystem, the marketplace is open and highly accessible to users worldwide.

By 2025, Russian Market is widely regarded as a one-stop shop for stolen data, known for its large inventory, user-friendly interface, and relatively low prices, making it especially attractive to entry-level and experienced fraudsters alike.

5. BidenCash

BidenCash was a high-profile carding marketplace that launched in 2022 and quickly gained notoriety for its bold branding and aggressive marketing tactics. Unusually, the site used the name—and even the image—of U.S. President Joe Biden, a move widely seen as an attempt to attract attention and mock authorities.

At its peak between 2022 and early 2025, BidenCash became a major hub for trading stolen credit card data and personal information. What truly set it apart was its promotional strategy: the platform regularly released massive dumps of stolen credit card data for free, generating widespread media coverage and drawing in large numbers of new users.

By mid-2025, BidenCash’s operation came to an end when law enforcement seized its domains, dealing a significant blow to the carding ecosystem and removing one of its most visible marketplaces.

6. WeTheNorth Market

WeTheNorth (WTN) is a darknet marketplace launched in 2021, best known for its strong Canadian focus and community-driven approach. Its name comes from a popular Canadian sports slogan, clearly signaling its regional identity from the start.

The market was created to fill the gap left by an earlier Canada-based darknet platform and has grown steadily since. By 2025, WeTheNorth serves both Canadian and international buyers, while maintaining a distinctly Canadian character through its vendors, product offerings, and support for both English and French.

At a time when the dark web is dominated by massive global marketplaces, WeTheNorth stands out as a successful regional market, thriving by catering to local preferences and building trust within a close-knit user community.

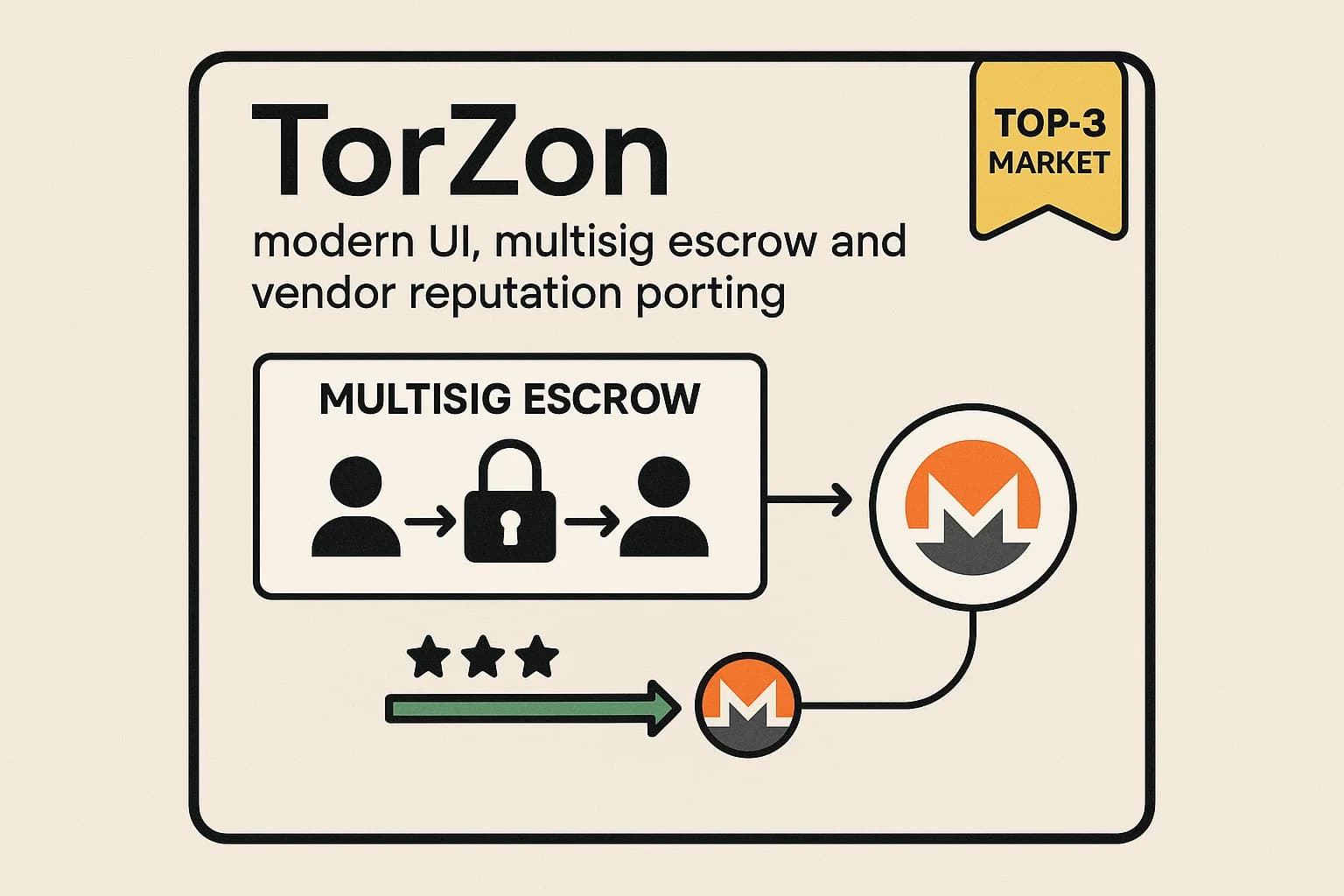

7. TorZon Market

TorZon Market (often styled as Torzon or TorZon) is a multi-purpose darknet marketplace launched in September 2022 that rapidly rose to prominence.

By 2025, TorZon is considered one of the leading English-language dark web markets, frequently described as a successor to earlier giants such as Abacus and AlphaBay. Its rise coincided with the collapse or failure of several major platforms, including Hydra’s 2022 takedown and AlphaBay’s unsuccessful relaunch, allowing TorZon to absorb displaced users and vendors.

The name reflects its home on the Tor network and appears to be a deliberate nod to “Amazon on Tor,” positioning TorZon as a large, all-in-one marketplace. True to that image, TorZon built a reputation for offering a broad range of illicit goods, while placing strong emphasis on user trust, escrow systems, and security features.

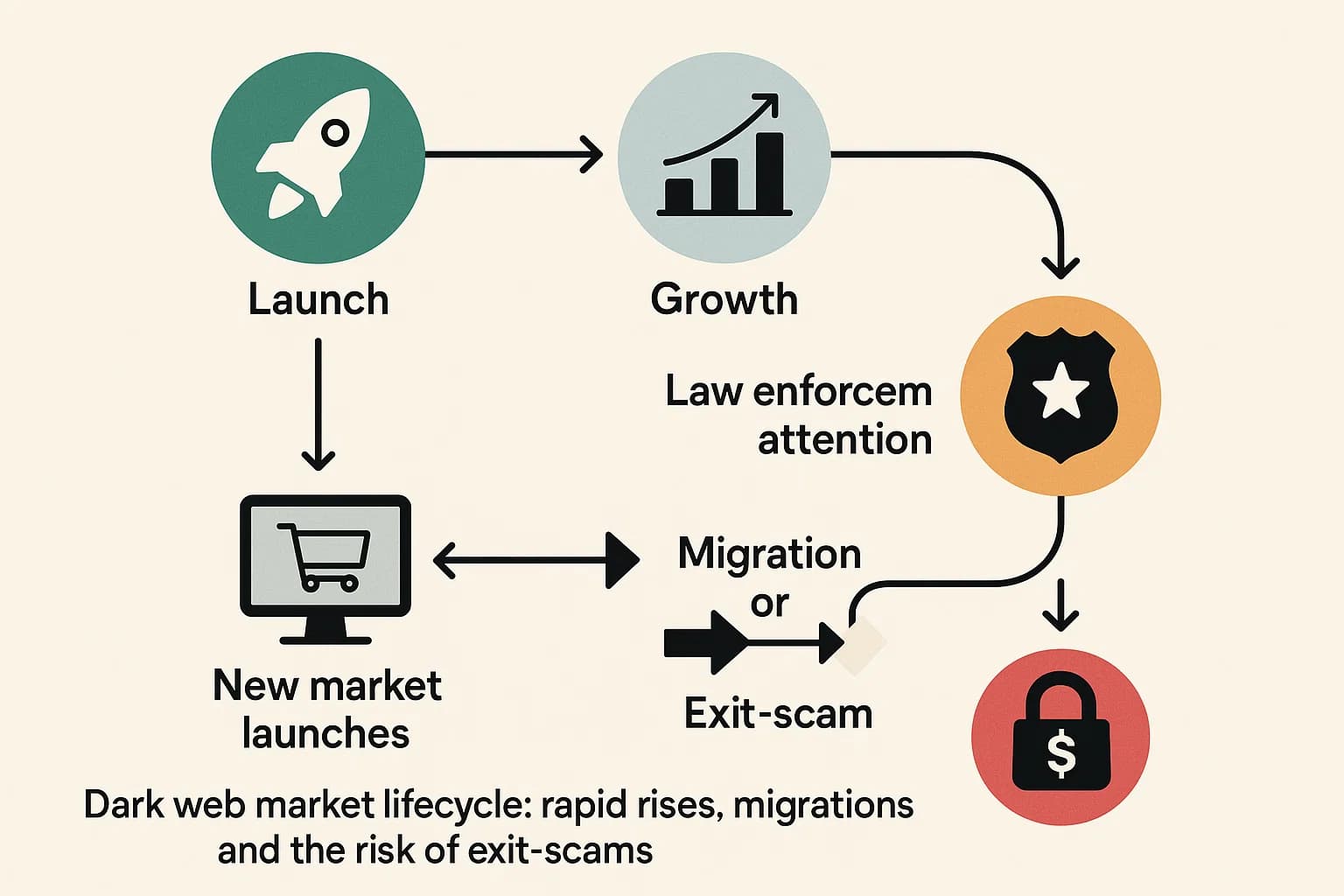

Dark Web Marketplace Trends in 2025

The dark web marketplace landscape in 2025 is in constant motion, shaped by aggressive law enforcement actions and rapid adaptation by cybercriminals. Markets rise quickly, fall just as fast, and are often replaced within days. This ongoing churn defines today’s underground economy.

Law enforcement pressure has intensified worldwide. Between 2022 and 2025, authorities carried out several large, coordinated takedowns targeting both marketplace operators and users. Operations like Europol’s SpecTor resulted in hundreds of arrests across multiple countries, while major platforms such as Hydra, Genesis Market, BidenCash, and Archetyp were dismantled. These actions disrupted billion-dollar ecosystems, seized servers and cryptocurrency, and caused significant losses for criminals. Notably, the lifespan of darknet markets has shortened dramatically—what once lasted years now often survives only months before being compromised.

In response, darknet communities have proven highly resilient. When a market is seized, vendors and buyers migrate almost immediately to alternative platforms, often coordinating through forums and encrypted channels. After Hydra’s fall, multiple Russian-language markets quickly absorbed its traffic. Similar migration waves followed later takedowns, with users flooding into markets like TorZon and other established platforms within hours. At the same time, new marketplaces frequently launch to fill the void, many of them region-specific or invite-only to reduce exposure and infiltration.

Another defining trend is consolidation. While new markets continue to appear, overall activity has concentrated around fewer dominant platforms. By 2025, most users gravitate toward a handful of trusted markets rather than spreading activity across dozens of smaller ones. This concentration is driven by reputation, liquidity, and fear of exit scams. As a result, users have become more cautious, depositing only minimal funds and treating each marketplace as potentially temporary.