Money Laundering Through Cryptocurrencies

Money laundering using cryptocurrencies generally follows the traditional placement–layering–integration model, but with several distinct characteristics that set it apart from conventional methods.

Unlike traditional financial systems, cryptocurrencies are often anonymous at the point of creation, which means the placement stage of money laundering is frequently unnecessary. Creating a cryptocurrency account, commonly referred to as a wallet address, takes only a few seconds and is completely free. Each address can be used simply to receive funds and then transfer them elsewhere, making tracking more difficult.

Cryptocurrencies also allow for highly complex laundering schemes to be carried out at minimal cost. Thousands of transactions can be automated and executed rapidly using computer scripts, enabling large-scale layering with very little effort.

Additionally, the extreme volatility of cryptocurrency markets provides an easy explanation for sudden wealth. With some digital currencies experiencing growth of up to 10,000%, criminals can plausibly justify unexpected income as investment gains.

To mitigate these risks, the United Nations Office on Drugs and Crime (UNODC) is actively conducting projects focused on cryptocurrency use and money laundering, aiming to better understand and combat these emerging financial crimes.

Privacy coins

Privacy coins are cryptocurrencies which offer a higher level of anonymous blockchain transactions, thus making the currency even less traceable than “normal” cryptocurrencies. The higher level of anonymity can be achieved, for instance, by concealing details about user addresses from third parties, such as information relating to the balance and the source of origin of the coins. This contrasts with how “normal” cryptocurrencies work where anyone can see the balance of an address, as well as transactions between addresses. However, some coins, like Monero, are private by design.

Cryptocurrency Mixing Technologies

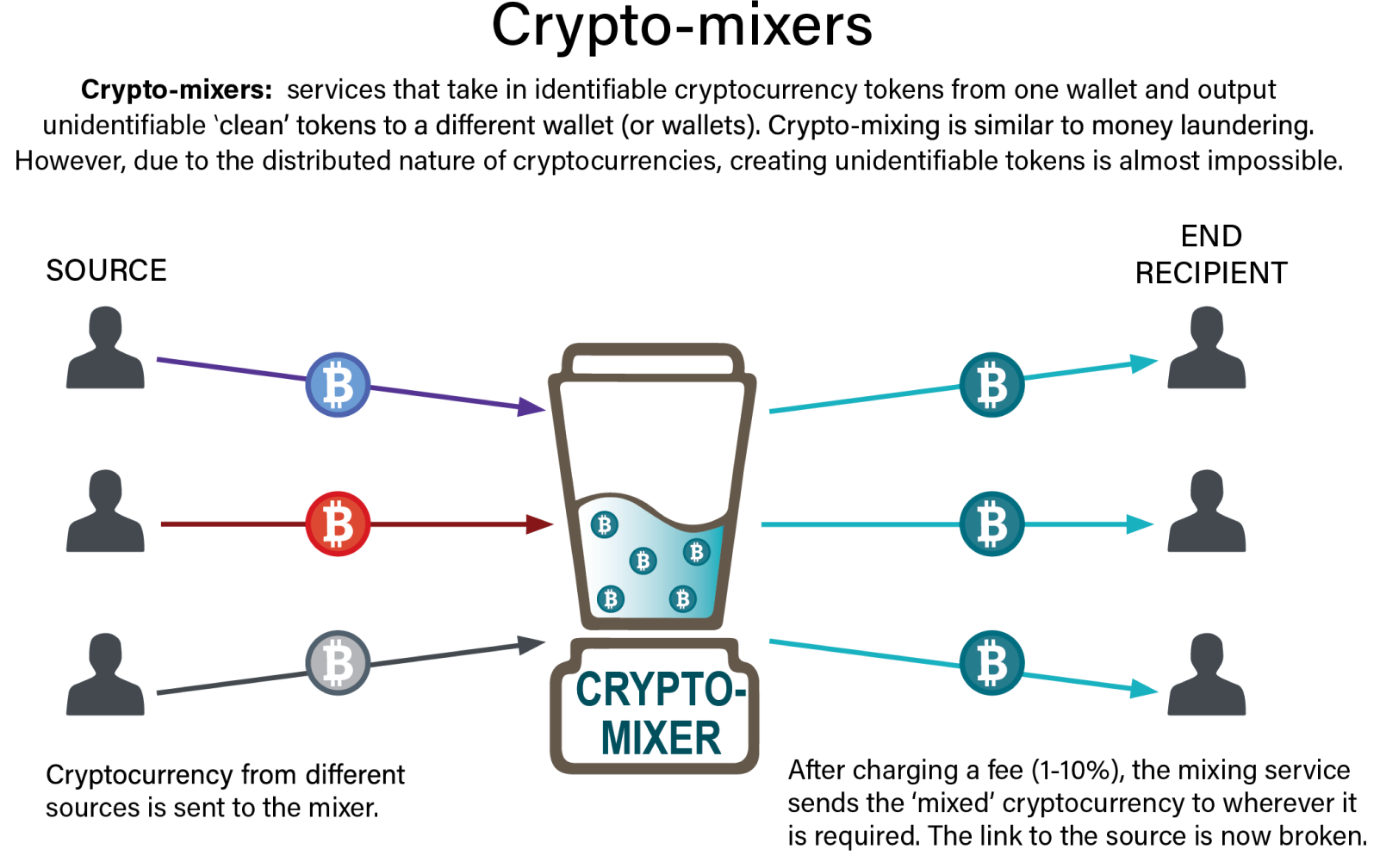

Illustration of a cryptocurrency mixer, showing how funds from multiple users are blended together and redistributed to different addresses to obscure their original source.

Several technologies are designed to “mix” or “blend” cryptocurrency funds in order to obscure their origin and make them difficult to trace. These methods intentionally break the link between the funds and their original source.

In a typical mixing process, cryptocurrency from multiple, potentially identifiable sources is first sent to a single address. Once combined, the funds are split into multiple smaller portions and transferred to different addresses. This process can be repeated many times across various accounts before the funds finally reach their destination.

As a result of this repeated mixing and redistribution, it becomes extremely difficult—if not impossible—to trace the funds back to their original source.

Prosecutors alleged that Ulbricht had paid for murder for hire plots against individuals he believed threatened Silk Road, though no killings occurred and he was not charged with murder in the New York case. Evidence related to these allegations was considered during sentencing. A separate Maryland indictment related to one alleged plot was later dismissed.

To mitigate these risks, Member States must implement effective regulation and supervision of cryptocurrency markets, ensuring greater transparency and stronger safeguards against misuse.